Forecasting is the art of saying what will happen, and then explaining why it didn’t. Anonymous (communicated by Balaji Rajagopalan)

The South African landscape lends itself to the fact that many individuals have limited education and training on basic financial literacy skills. These individuals form part of the pool of prospective entrepreneurs. Without basic financial literacy and adequate business knowledge, an entrepreneur might not distinguish profit from cash in the bank. They start living a lavish life and realise too late that there is no money to pay funders, investors, suppliers, employees, and creditors. It can be argued that countless prospective entrepreneurs do not understand the financial requirements and obligations of a business, including aspects such as tax obligations, financial costing, pricing strategies, financial control and VAT. Financial projections can be difficult and time consuming to compile, especially for start-up companies that have not past trading record.

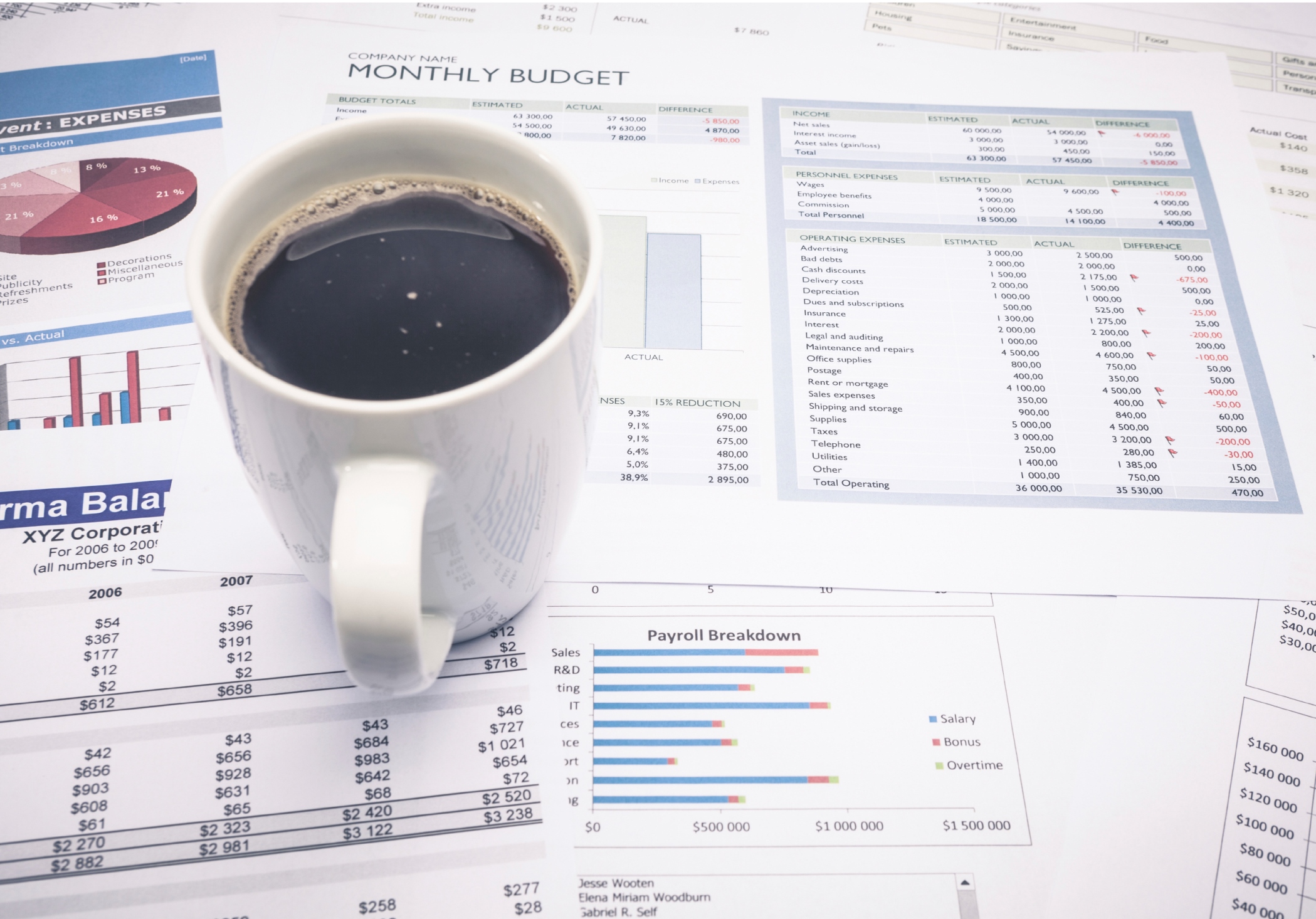

Following is a list of the most common wrong fiscal assumptions made when compiling a Financial Projections Model:

- Underestimating operating costs. While entrepreneurs remember the obvious expenses, they often forget related items that can quickly add up. As an example, expense items such as insurance, employee-related costs, e.g. PAYE, UIF, pension fund contributions, etc. are often omitted, which can severely impact the expected operational expenses.

- Underestimating start-up costs. Entrepreneurs are routinely too optimistic about how quickly sales will build and their business will sustain itself. They often mistakenly believe that as soon as they close a sale they’ll have money. They forget that people can sometimes only pay after 60 days or in some cases, not pay at all.

- Mispricing products or services. New entrepreneurs often arrive at a price for their product or service by adding up their costs and adding on the margin they think they ought to make. The approach is typically too simplistic and ignores important factors like market position and the real value of your product.

- Not providing a cash-flow analysis. Potential investors want to see that you understand the concept of cash flow and how you intend to spend their money.

- Underestimating your variable expenses. While fixed expenses are those that will stay constant and you can expect to pay consistently, variable expenses will vary depending on your level of business activity. Of course there’s no way to definitively account for all variable expenses, but you can identify key variables, take them into consideration, and factor them into your calculations.

- No assumptions listed. When you create a set of financial projections you are making numerous assumptions. Some of those assumptions might not be that important because they make a small impact on your bottom line. Potential investors probably doesn’t care if you are off by a rand or two on the price of stationery, so don’t worry about listing that assumption, but for assumptions that have the potential to impact your profitability and cash balance in a significant way, make sure to include a listing of important assumptions with your financial projections.

- No bad debt expense. Business owners commonly exclude bad debt expense from their budget. Bad debt expense can vary greatly depending on industry, but there are few industries where you collect every rand of sales earned. Will 1% of your customers fail to pay, or will 10% fail to pay? This is an important consideration, and failing to include this line item in your forecast can be a warning sign for potential investors.

- Excluding loan payments. This is probably the worst mistake entrepreneurs make, forgetting to include your loan payment in your financial projections. If you are applying for a loan, you should estimate the interest rate, amount, and length of loan to come up with a projected monthly payment. Moreover, the interest portion payable needs to be reflected in your Profit and Loss (Income) Statement while the capital portion payable needs to be reflected on the Cash Flow Statement.

- No contingency and room for error. If your financial projections leave no room for error investors and bankers will be nervous. Leaving no margin for error means that if even one assumption is wrong, you could go bankrupt. Typically, banks don’t take those kinds of risks, so if your projections are that fragile, you may want to focus on including a contingency to absorb the potential risk.

- Excluding founder salary. If you want to operate a sustainable business, then at some point you need to take home a salary as the owner. If your projections never include a salary for yourself, your bankers and investors are going to recognise that you can’t continue to operate this way forever. If the business can’t afford to pay you and still make a profit, then this probably is not a business that a bank or investor would be willing to put money into. Make sure to include a modest salary for yourself to demonstrate truly realistic financials.

Forecasting future events is often like searching for a black cat in an unlit room, that may not even be there. Steve Davidson in the Crystal Ball